Ineffective loan agreement with immoral interest rate!

Hope for affected debtors

Nobody willingly signs a loan agreement with an extraordinarily high interest rate if this cannot be avoided in practice. The financial pressure in which many borrowers find themselves forces many of them to make economically unreasonable decisions. Banks shamelessly exploit this and demand sometimes horrendous interest rates from those affected.

Legislation and established case law set limits on banks' interest rate practices.

If the agreed interest rate is too high, the loan agreement may be immoral and therefore void.

The consequence of an immoral loan agreement is that the borrower concerned only has to repay the net loan amount.

The borrower does not have to pay interest on an immoral loan. Previous payments made by the person concerned are offset in full against the net loan agreement to be repaid.

You might think that immoral loan agreements should be rare in practice. Unfortunately, this is not the case.

Here is an example case from our legal practice:

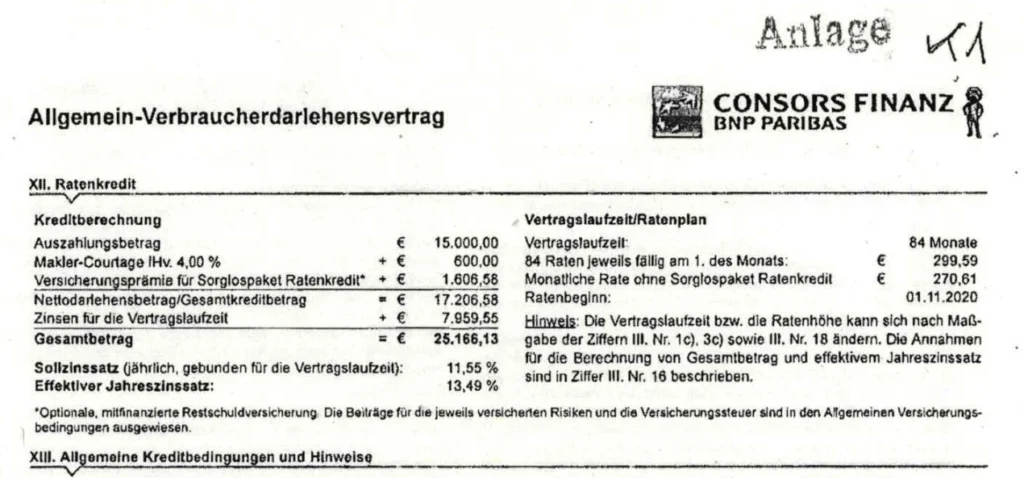

I. Conclusion of contract with Consors Finanz BNP Paribas S. A.

In September 2020, the borrower concerned concluded a consumer loan agreement with a total term of 84 months with Consors Finanz (BNP Paribas S. A.).

An effective annual interest rate of 13.49% was agreed for the entire term of the loan agreement.

II. Cancellation and action by the creditor

The borrower was no longer able to pay the loan instalments after a certain period of time, so the lender terminated the consumer loan agreement granted and took legal action against the borrower concerned for repayment of the outstanding loan amount.

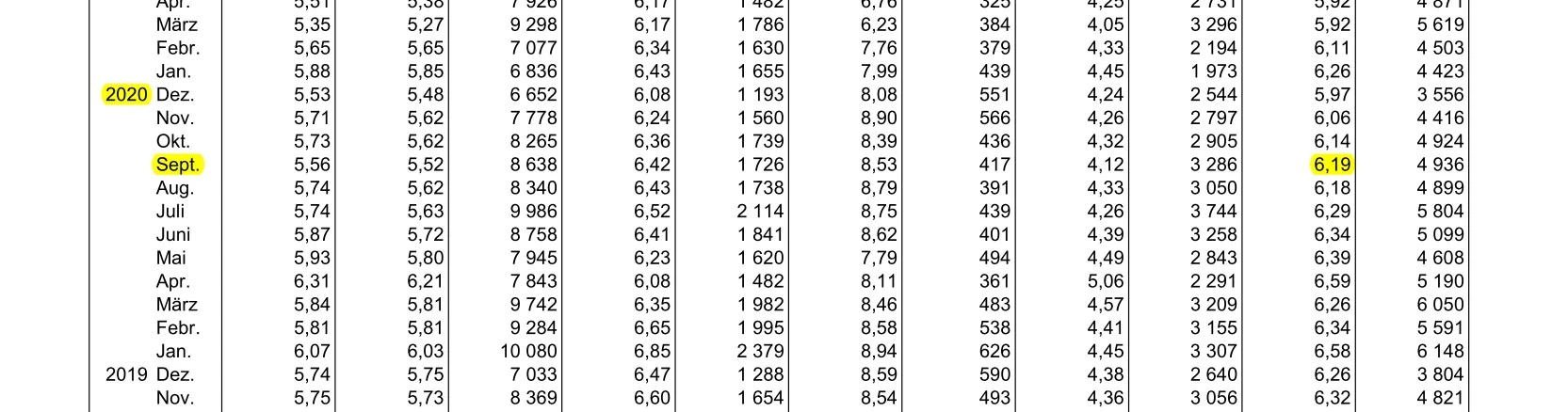

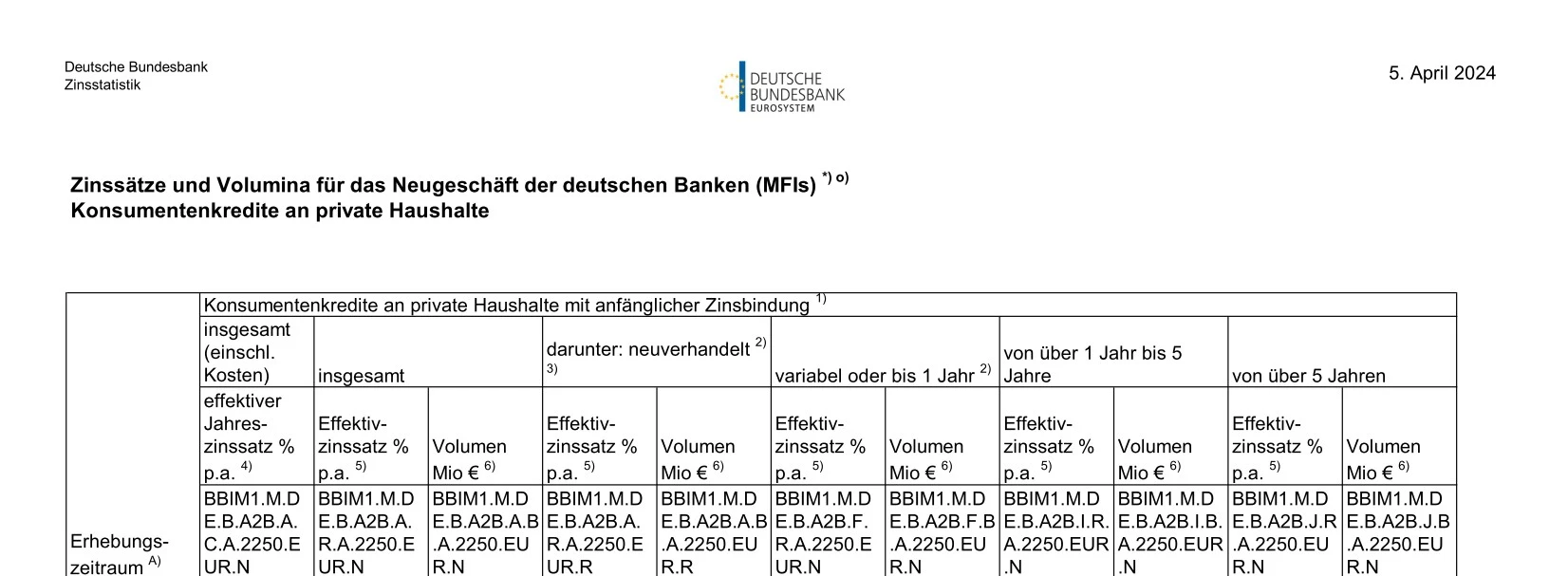

III. A look at the interest rate statistics of the Deutsche Bundesbank

The Deutsche Bundesbank maintains (MFI) interest rate statistics that can be viewed on the Internet, which can be used to view historical interest rates from the past. These interest rate statistics can also be downloaded as a file. The statistics list the respective average interest rates for each month in the past depending on the term of a loan agreement.

In connection with consumer loan agreements, the section "Consumer loans and other loans to private households" should be noted.

In this case, the average interest rate for consumer loans to private households with a term of more than five years was effectively 6.19% per year at the time the contract was concluded in September 2020.

IV. Standard for immorality

Rechtlicher Anknüpfungspunkt für die Annahme der Sittenwidrigkeit ist § 138 BGB.

There it says:

Section 138 Unethical legal transaction; usury

A legal transaction that is contrary to accepted principles of morality is null and void.

In particular, a legal transaction by which someone exploits another person's predicament, inexperience, lack of judgement or considerable weakness of will to promise or grant themselves or a third party pecuniary benefits in return for a service that are conspicuously disproportionate to the service is null and void.

A contractual relationship is null and void due to a breach of good morals if there is an objectively noticeable imbalance between performance and consideration and the other party to the contract was subjectively aware of the actual circumstances giving rise to the immorality.

The existence of an objectively noticeable imbalance between performance and consideration generally leads to the subjective element being assumed.

According to established case law, there is a conspicuous imbalance between performance and consideration in loan agreements if, among other things, the contractual effective interest rate exceeds the standard market interest rate by around 100% (BGH, judgement of 24 March 1988, case reference: III ZR 30/8, NJW 1988, 1659; BeckOGK/Jakl, 1.1.2024, BGB, Section 138, marginal no. 205).

In this case, the agreed interest rate at the time the contract was concluded was effectively 13.49% per year. This is 118 % above the average interest rate of 6.19 % per annum, according to the interest rate statistics of the Deutsche Bundesbank.

In this case, the consumer loan agreement is immoral and therefore void due to the violation of common decency.

V. Consequences of immorality

As already mentioned at the beginning, the nullity of the consumer loan agreement means that our client does not have to pay any interest at all.

For the court case, this means that the bank will lose part or all of the claim, depending on how much of the net loan amount has already been paid.

Even if the disbursed loan would still have to be returned in part, the invalidity of the consumer loan agreement or the impending court decision on this can be a reason for negotiations between the borrower and the lender, as no bank has an interest in "attracting attention" with immoral interest rates before the German courts.

VI. Conclusion

The case we have explained from our legal practice clearly shows once again that, as an affected borrower, you should not immediately throw in the towel.

If you have any doubts about the validity of a loan agreement you have concluded or if you are even being sued for repayment, you should contact our Düsseldorf law firm as soon as possible.

In individual cases, we check the validity of the loan agreement and handle all correspondence for you.

You can send us a message at any time using our contact form. Alternatively, you can also send us an e-mail to info@topuz-law.de or call our office directly on +49 211 43637831. Our secretary will answer your call within our opening hours. You will usually receive a response from us within 24 hours.

Tolga Topuz

Lawyer

Topuz Law – Kanzlei aus Düsseldorf –